If you are setting up your e-commerce website on WooCommerce you must be thinking about how to set up GST in your billing system. The excellent point is you don’t need any additional plugins to do this. It is very easy to configure GST taxation on your website so let us see how.

What is GST?

GST is also known as Goods and Services Tax which came to force on 1st July 2017 in India. Under this system State and Central government tax is combined and added to your bill. We have different slabs of GST like 5, 12, and 18 percent, it depends upon the type of good you are selling and which slab it will fall in.

How will I set up the GST system on my WooCommerce website?

So, to set up GST taxation on your WooCommerce website let us assume you sell two types of products Product A and Product B. Product A falls under the 18 percent GST slab and Product B under 12 percent. Let us follow these steps to set up our GST system:

Activate the Tax system on your website:

- Login to your WordPress dashboard

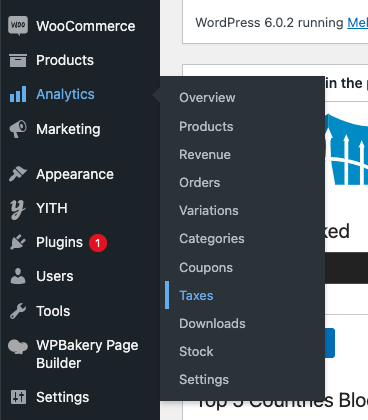

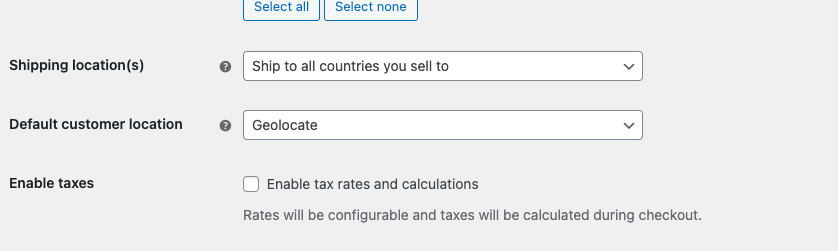

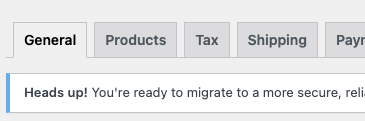

- Click on WooCommerce à Settings à General

- You need to check ‘Enable tax rates and calculations’ checkbox

- Save the setting

- Now you will see Tax Tab in your WooCommerce dashboard

Now Configure Tax Options

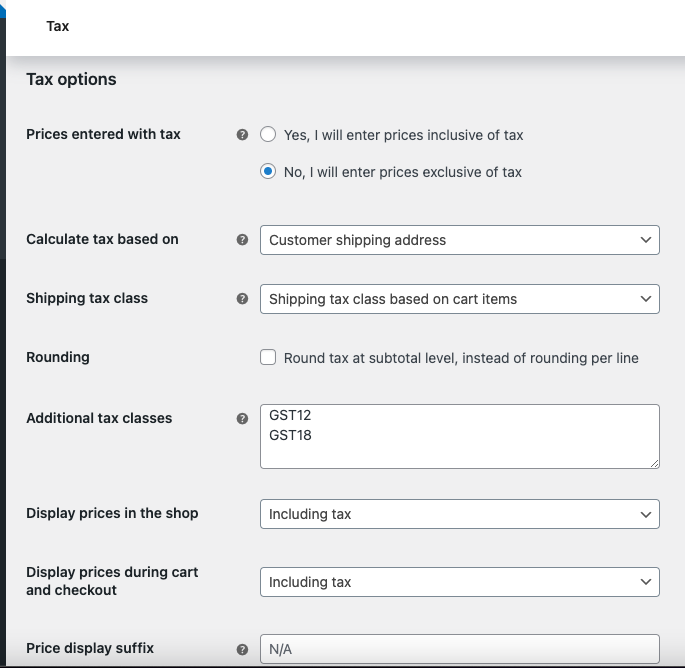

- Select `No, I will enter prices exclusive of tax`

- Also, set all your settings like this:

- Now save your setting

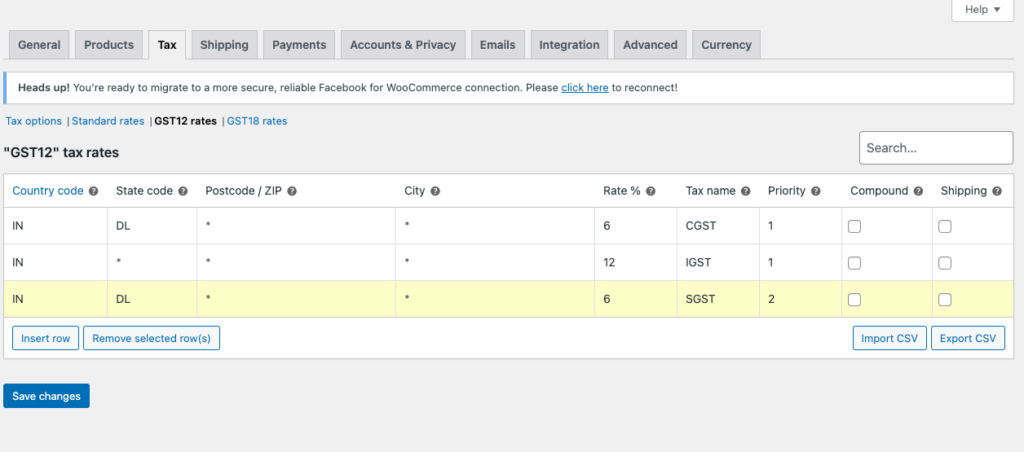

- Now you will have two new sub-tabs 18GST and 12GST. Select 12GST now.

- Follow settings in the below screenshot, these settings are created assuming your State is Delhi change your State code:

- Similarly, do it for tab 18 percent

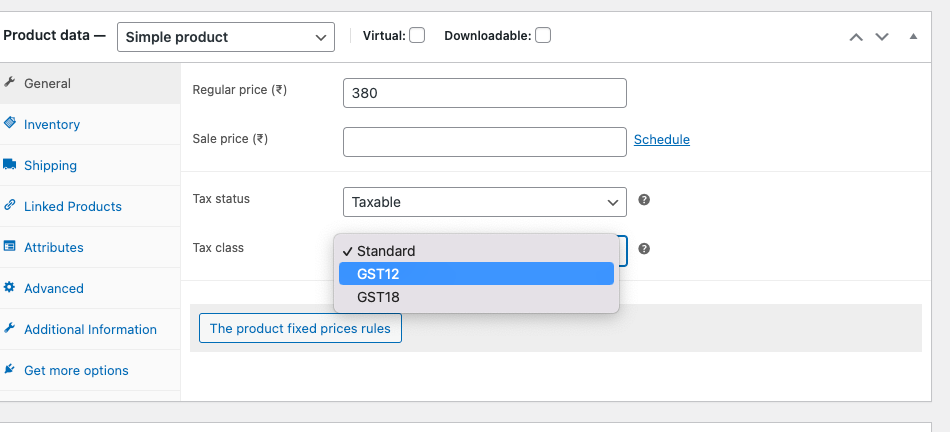

- The second step is to link these GST tax classes to the products

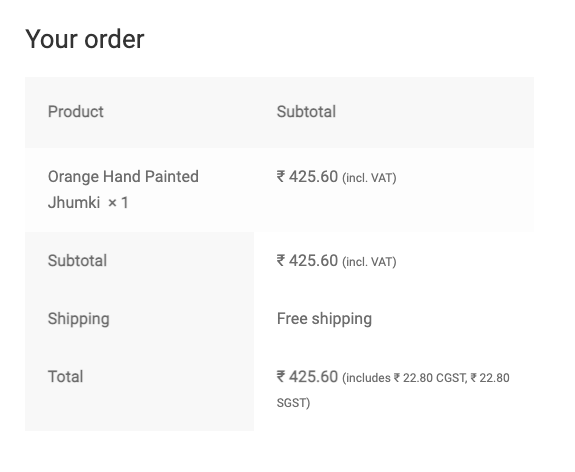

- You will see tax calculations on the cart and checkout page like this: